In the wake of a recent announcement by Mark Zuckerberg, CEO of Meta, the company experienced a dramatic decline in its market value. This announcement, made during the company’s earnings report, has raised concerns among investors about the future profitability of Meta’s ambitious investments in artificial intelligence (AI).

Mark Zuckerberg’s statement during the earnings call, indicating that it could take “several years” for the company’s AI initiatives to yield significant returns, served as a catalyst for investor unease. The implication that Meta’s AI endeavors may not generate revenue as quickly as anticipated has prompted fears that the company’s financial outlook might be less robust than previously believed.

Market Reaction

The apprehension surrounding Meta’s AI strategy triggered a widespread sell-off of the company’s shares, resulting in a staggering loss of nearly $190 billion in market capitalization. When trading commenced on Thursday morning, Meta’s stock plummeted by almost 15 percent, reflecting investor apprehension about the company’s future prospects.

Other tech giants experienced declines in their share prices, feeling the repercussions of Meta’s stock decline across the social media landscape. Snap witnessed a 4.8 percent drop, while Alphabet, Amazon, and Microsoft saw their stocks decrease by between 1.5 and 2.7 percent, respectively. The contagion effect underscores the interconnectedness of the tech industry and highlights the impact of Meta’s performance on the broader market sentiment.

Zuckerberg’s Reassurance

In response to the market turmoil, Mark Zuckerberg sought to assuage investor concerns by reaffirming the potential for profitability in Meta’s AI endeavors, albeit acknowledging that the realization of such gains may be delayed. He outlined various avenues through which Meta could monetize its AI products, including scaling business messaging, integrating advertisements or paid content into AI interactions, and offering premium AI models for a fee. Additionally, Zuckerberg emphasized the role of AI in enhancing app engagement, thereby facilitating more effective advertising strategies and delivering greater value to advertisers.

In summary, Meta’s recent stock plunge underscores the challenges and uncertainties inherent in the company’s AI-driven strategy. While Mark Zuckerberg remains optimistic about the long-term prospects of Meta’s AI initiatives, the market’s reaction highlights the need for the company to demonstrate tangible progress and deliver on its promises to investors in the coming years.

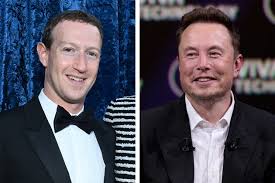

See also: Musk Surpasses Zuckerberg In Wealth: A Turn Of The Tables